Taxes for Expats - The US - China Tax Treaty

Por um escritor misterioso

Descrição

The US-China tax treaty was signed in 1984 and came into affect in 1987. How does it affect or help US expats living in China?

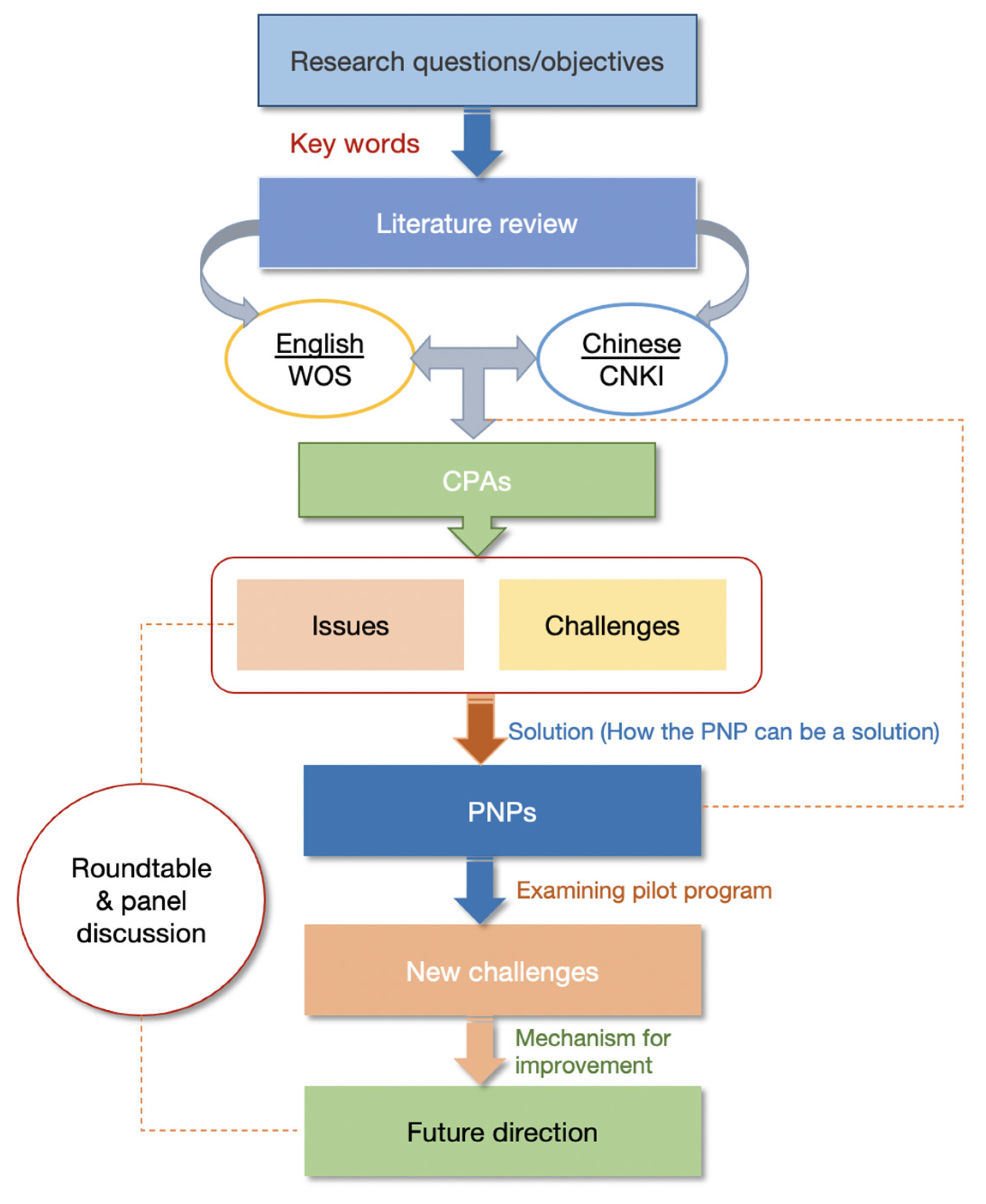

Claim Tax Treaty, Avoid Double Taxation and Request VAT Exemption

Common Expat Tax Forms: US Expat Taxes Explained

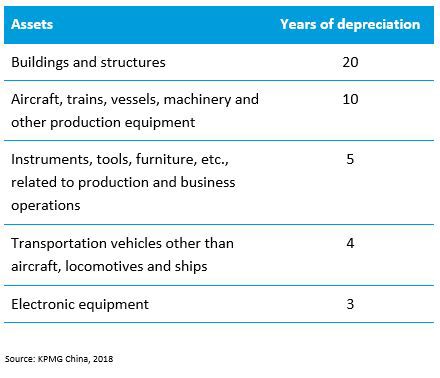

China - Taxation of cross-border M&A - KPMG Global

China-US Tax Services - International Tax CPA, Expat Tax

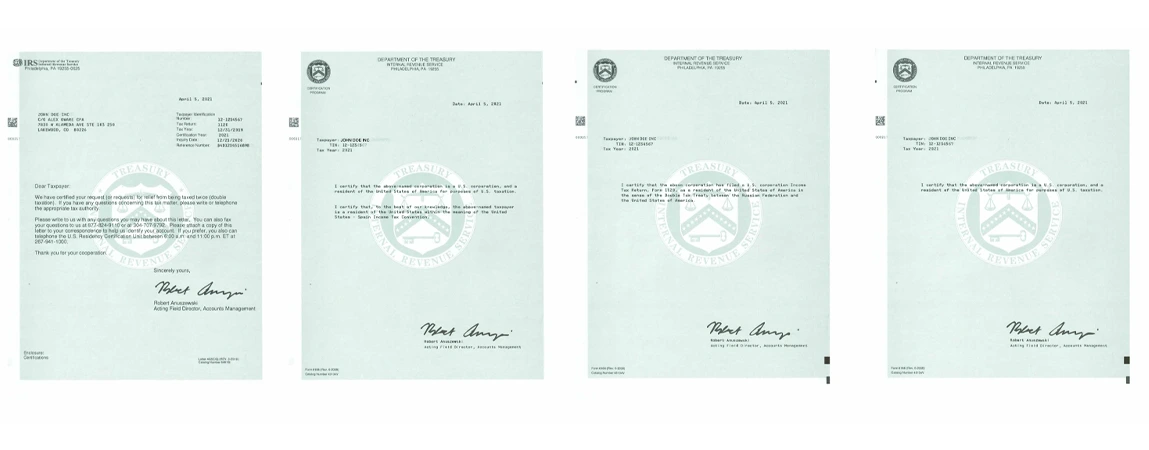

IRS Form 8833 and Tax Treaties - How to Minimize US Tax

Claiming income tax treaty benefits - Nonresident taxes [2023]

20 Things to Know About U.S. Taxes for Expats

How to Avoid Double Taxation in Joint Venture Agreement?

China - Taxation of cross-border M&A - KPMG Global

US Expats Living in Hong Kong - Filing Taxes

China-United States International Income Tax Treaty Explained

2023 Mexican Tax Considerations for Mexican and Foreign Taxpayers

Citizenship-Based Taxation: Who's Tried It & Why the US Can't Quit

China Income Tax

IRS Form 2555

de

por adulto (o preço varia de acordo com o tamanho do grupo)