Retirement planning: Health care costs in retirement

Por um escritor misterioso

Descrição

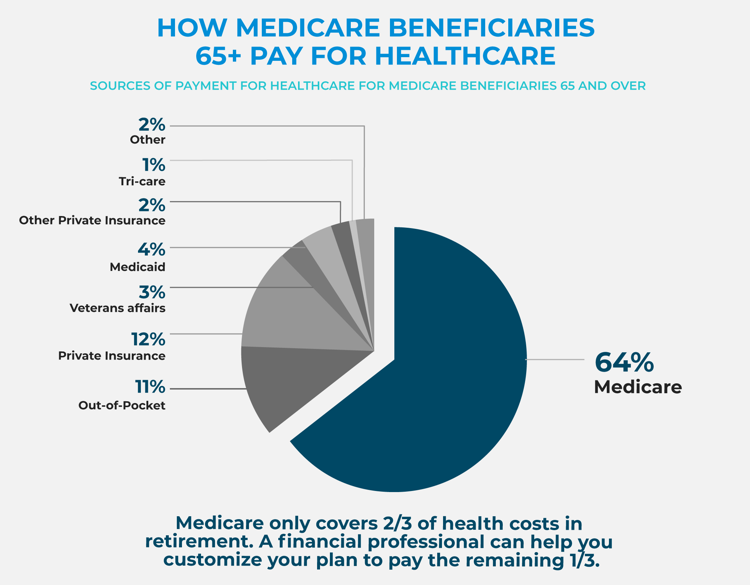

The average retired couple age 65 will need $315,000 to cover health care expenses during retirement. But there are ways to plan ahead and mitigate these expenses.

The Retirement Café: February 2016

Planning for the Cost of Healthcare in Retirement

Yes, Health Insurance Costs Impacted My Early Retirement (FIRE) Plans — My Money Blog

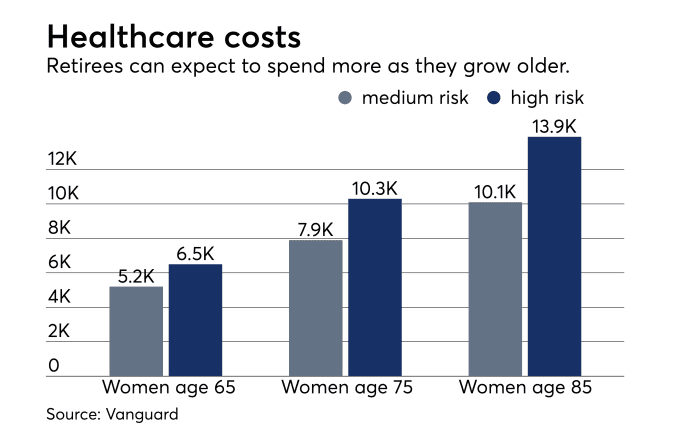

Healthcare costs in retirement, What will healthcare cost?

Inflation taking a toll on health care and nutrition decisions in U.S.

PANC 2022: Health, Wealth and Retirement

Plan for Retirement

Retirement Plan Trends in the Healthcare Industry

The Real(ly Manageable) Cost Of Health Care In Retirement

Helping Employees Prepare for Current and Future Health Care Costs

Retirement planning: How much money will you need to cover your healthcare expenses?

Unsure About the Annual Cost of Healthcare in Retirement? Here's Why It Matters

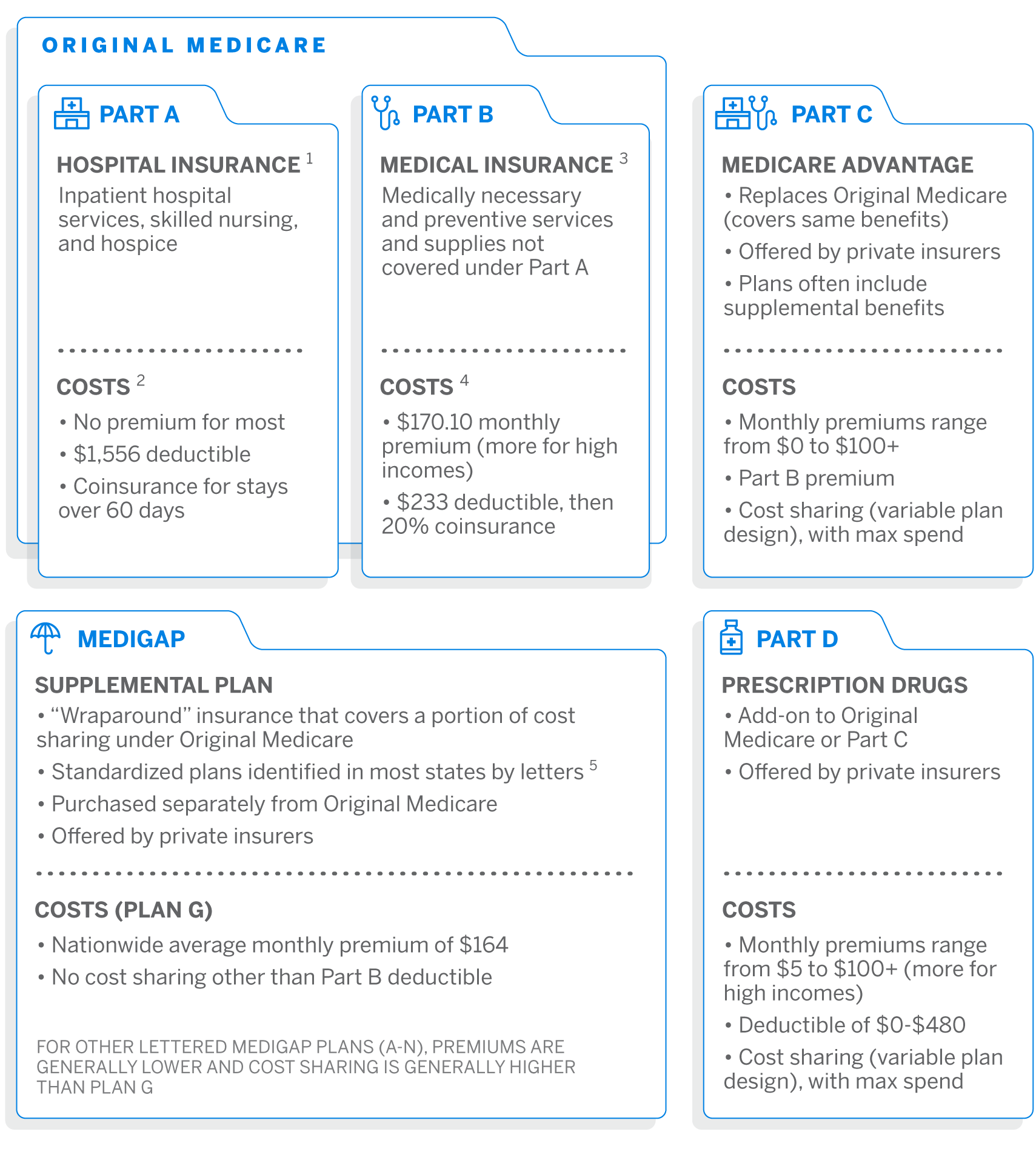

Health Costs in Retirement: Medicare, Insurance & Expenses

Three healthcare costs your retirement plan should address

Long-Term Care, Clarity Financial Solutions, Financial and Retirement Planner

de

por adulto (o preço varia de acordo com o tamanho do grupo)