Publication 970 (2022), Tax Benefits for Education

Por um escritor misterioso

Descrição

Publication 970 - Introductory Material Future Developments What's New Reminders

Tax Credit – 1098-T, Student Financial Services

The unique benefits of 529 college savings plans

Education tax credits: Maximizing Savings with IRS Pub 970 - FasterCapital

Teacher Expense Income Tax Deduction Raised to $300 - CPA Practice Advisor

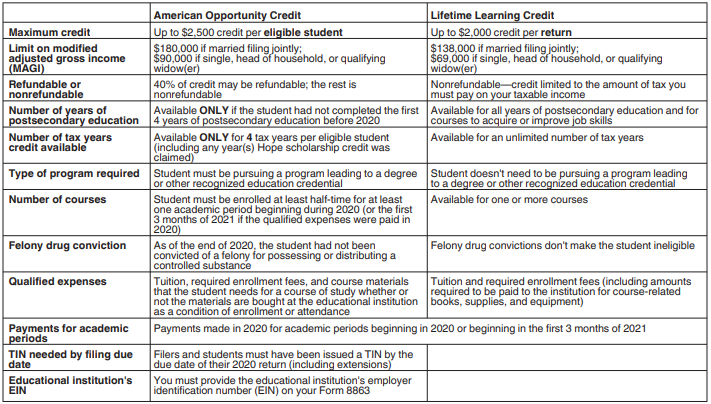

What to know about tax credits for education

1040 - American Opportunity and Lifetime Learning Credits (1098T)

Tax Credits for Education Waubonsee Community College

Do you have to claim student loans on your taxes?

Maximum 2023 Educator Expenditure Deduction is $300

Tax benefits for education cheat sheet

Coverdell Education Savings Account: Exploring the Details in IRS Pub 970 - FasterCapital

The 2 Education Tax Credits for Your Taxes

de

por adulto (o preço varia de acordo com o tamanho do grupo)