28/36 Rule: What It Is, How to Use It, Example

Por um escritor misterioso

Descrição

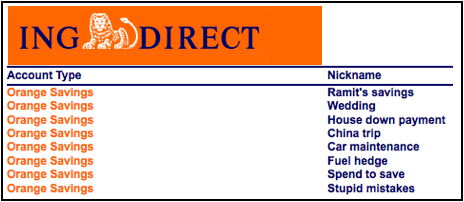

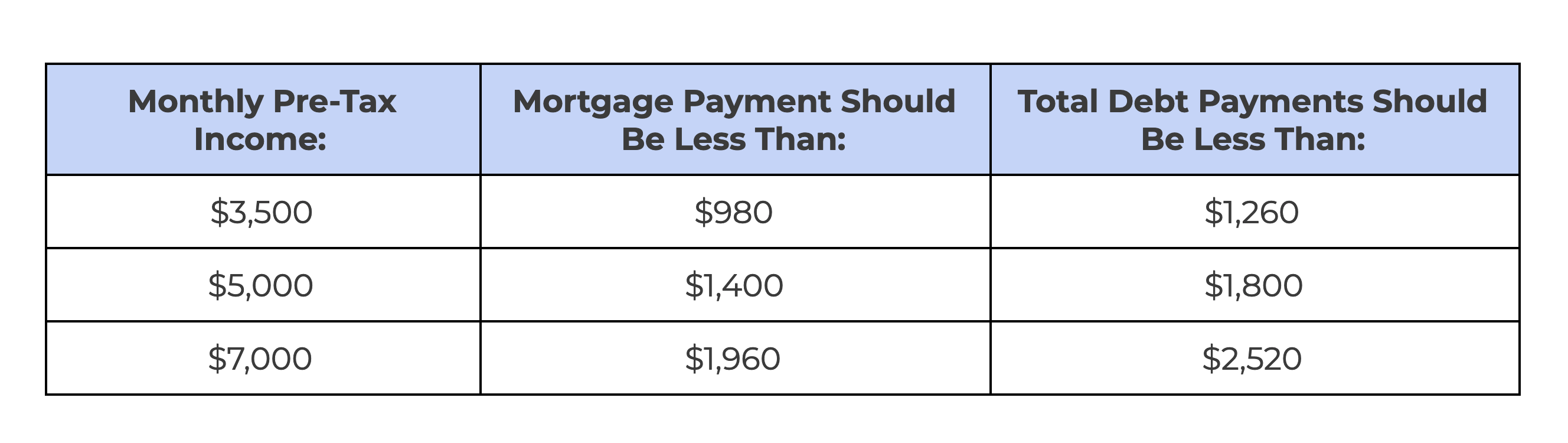

The 28/36 rule calculates debt limits that an individual or household should meet to be well-positioned for credit applications. It measures income against debt.

Debt-to-Income (DTI) Ratio: What's Good and How To Calculate It

How Much House Can I Afford Using The 28/36 Rule?

What Is the 28/36 Rule and How Does It Affect My Mortgage?

Debt to Income Ratio: Key to Mastering the 28 36 Rule - FasterCapital

36 28 rule|TikTok Search

Demystifying the 28 36 Rule: A Step by Step Approach for Homebuyers - FasterCapital

Demystifying the 28 36 Rule: A Step by Step Approach for Homebuyers - FasterCapital

Ashley Nicole Brown-Realtor

Demystifying the 28 36 Rule: A Step by Step Approach for Homebuyers - FasterCapital

What Percent Of Income Should Go to Mortgage? — Budgetry

Home Buying Budget: How Much House Can I Afford?

de

por adulto (o preço varia de acordo com o tamanho do grupo)