Breaking Down The Impact Of UK's Value Added Tax On Sellers

Por um escritor misterioso

Descrição

recently announced that sellers on its U.K. platform will be required to pay a 20% value-added tax on fees paid to the company beginning August this year. The new VAT is applicable to sellers that have annual turnover (sum total of all goods sold through the website) in excess of £85,000.

:max_bytes(150000):strip_icc()/brexit.asp_final-23d572e0478542dfa7f2493350540677.png)

Brexit Meaning and Impact: The Truth About the U.K. Leaving the EU

The effect of tax cuts on economic growth and revenue - Economics Help

Effects of taxes and benefits on UK household income - Office for National Statistics

UK VAT (Value Added Tax) Guide - Updated for Post Brexit Impact

Value-added tax: What is VAT and who has to pay it? - Avalara

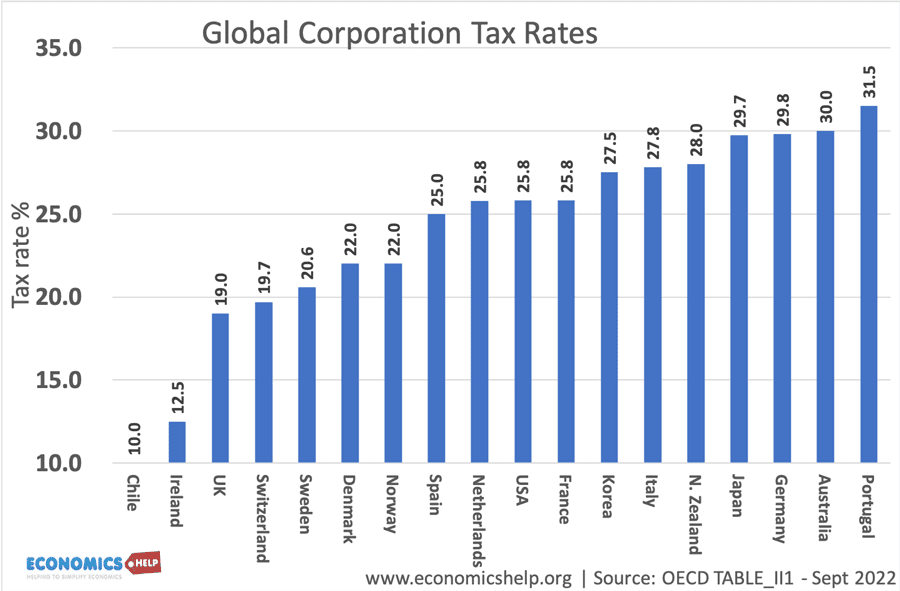

Business Tax in the UK: Everything You Need to Know - NerdWallet UK

What are the VAT implications when selling to UK, USA and worldwide customers?- EU - Value Added Tax

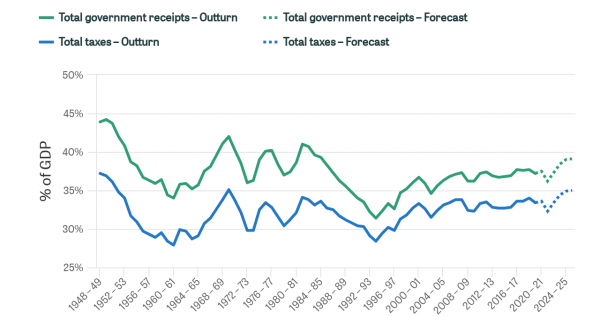

How have government revenues changed over time?

Instant Download 50th Birthday 1973 British Newspaper Front

Tax Incidence: How the Tax Burden is Shared Between Buyers and Sellers

de

por adulto (o preço varia de acordo com o tamanho do grupo)