What are FICA Taxes? Social Security & Medicare Taxes Explained

Por um escritor misterioso

Descrição

Federal taxes for Social Security and Medicare (FICA) are mandatory, so understanding them is important for all HR professionals. Here’s what you need to know.

FICA Tax: What It is and How to Calculate It

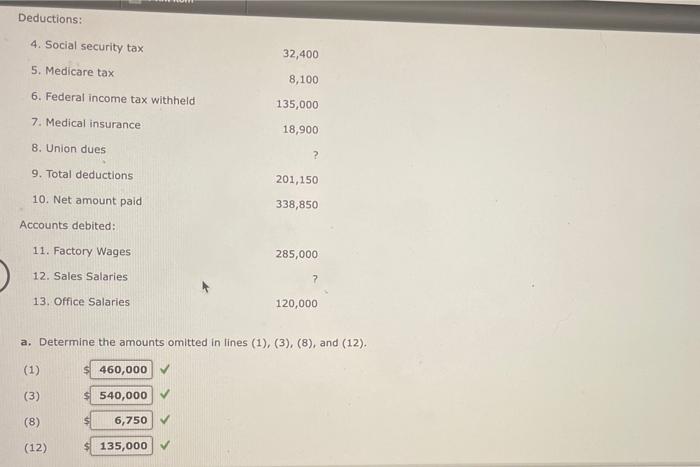

Solved Summary Payroll Data Assume that the social security

SOCIAL SECURITY TAX AND THE MAXIMUM TAXABLE INCOME LIMIT

2023 FICA Tax Limits and Rates (How it Affects You)

Income Taxes: What You Need to Know - The New York Times

FICA explained: Social Security and Medicare tax rates to know in 2023

Maximum Taxable Income Amount For Social Security Tax (FICA)

What is the Social Security Tax?

What Is Medicare Tax? Definitions, Rates and Calculations

FICA Tax Exemption for Nonresident Aliens Explained

What is FICA Tax? - Optima Tax Relief

What are the major federal payroll taxes, and how much money do

Understanding Your Paycheck

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

Federal Insurance Contributions Act (FICA): What It Is, Who Pays

An Updated Analysis of a Potential Payroll Tax Holiday – ITEP

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)