What Eliminating FICA Tax Means for Your Retirement

Por um escritor misterioso

Descrição

A recent poll out said that over 60% of current retirees are relying on social security and Medicare for a majority of their income in retirement. So while getting rid of FICA tax sounds nice now because nobody likes paying taxes, it could be detrimental not just to retirees or when you can retire

Medicare & Social Security Reform: US Debt & Deficit Crisis

The Average American Pays This Much in Social Security Payroll Tax

13 States That Don't Tax Your Retirement Income

:max_bytes(150000):strip_icc()/retirement-planning.asp-FINAL-ed21279a08874c54a3a0f4858866e0b6.png)

What Is Retirement Planning? Steps, Stages, and What to Consider

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes on Earnings After Full Retirement Age

How to Cut Your Social Security Taxes

Hearing: Social Security's Disservice to Public Servants

Do States Tax Social Security Benefits? Missouri Changes Law

Social Security taxes up to $147,000 in wages. That could change

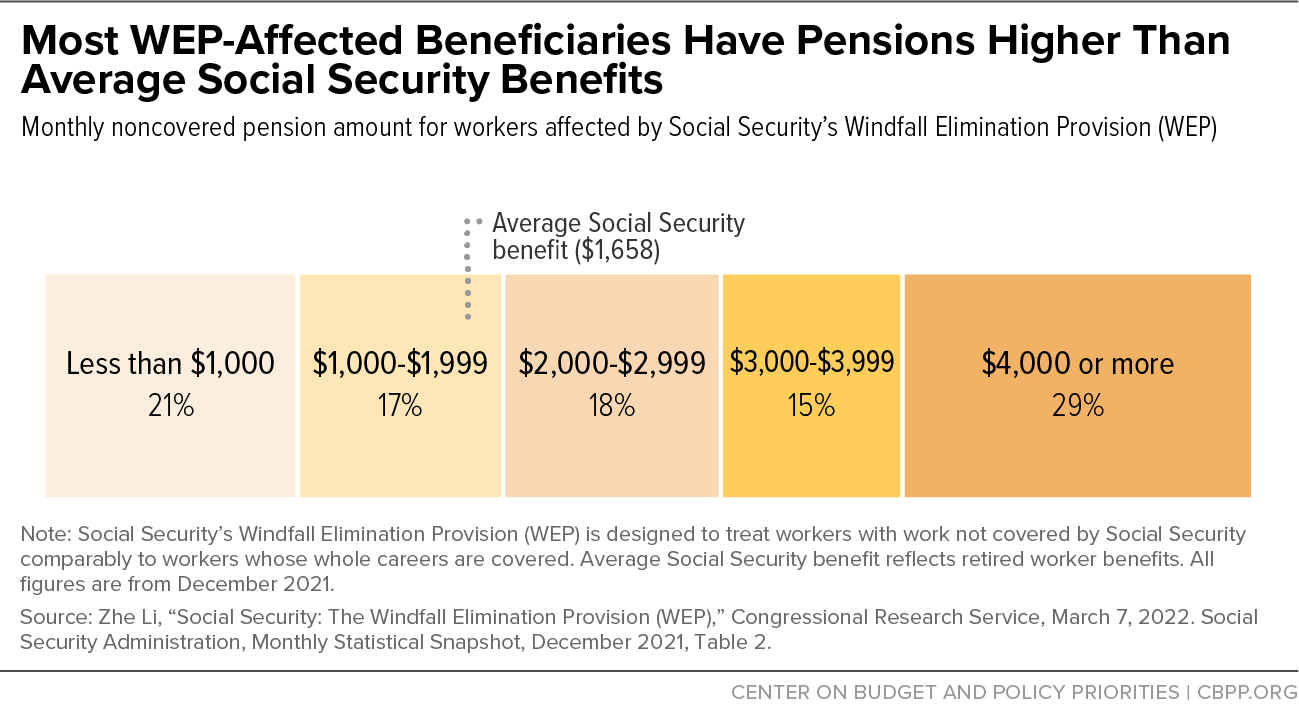

Program Explainer: Windfall Elimination Provision

Social Security and CSRS Employees: Eliminating and Offsetting

How a pension can reduce your Social Security benefits

Repealing Social Security's WEP and GPO Rules Would Be Misguided

2023 FICA Tax Limits and Rates (How it Affects You)

13 Things You Need to Know About Social Security — Vision Retirement

de

por adulto (o preço varia de acordo com o tamanho do grupo)

.jpg)

/i.s3.glbimg.com/v1/AUTH_bc8228b6673f488aa253bbcb03c80ec5/internal_photos/bs/2020/E/R/BnwkzoS36DAdg8znYeNA/taca-serie-c.jpeg)